The role of the brain in financial decisions

A viewpoint on neuroeconomics

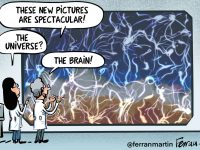

In this article, we explain the important role neuroscience plays in economic and financial environments. Hence, we present neuroeconomics as a way to describe how decision-making processes affect brain activity, focusing especially on the importance of economic and financial decisions. We answer some questions regarding the role of emotions in finance, the psychological factors present in financial markets, and how neuropsychological stimuli affect our economic decisions. We conclude by citing the main research in the area of neuroscience in financial decision-making processes, and highlight further research projects in these areas.

Keywords: financial markets, decision-making, neuroeconomics, brain.

«We understand neuroeconomics as the field that studies brain activity while making economic decisions»

In recent years, neuroscience-related research has surged. Technological advances have allowed researchers to improve our understanding of how our brains work when we make decisions: we now know that different situational factors may affect our decision-making processes at a neuropsychological level (Camerer, 2007). Within this framework, neuroeconomics has emerged as a research field concerned with the study of the brain when dealing specifically with economic decisions. In other words, we understand neuroeconomics as the field that studies brain activity while making economic decisions (Camerer, Loewenstein, & Prelec, 2005). In this article we will review the literature regarding this field in order to describe the neuropsychological basis of decision-making processes, focusing on economic and financial decisions.

Neuropsychological function in economic decision-making

Decision-making processes have puzzled researchers for decades. Several domains of scientific inquiry including psychology, business management, or economics, among others, have studied them (Bertrand, Mullainathan, & Shafir, 2006). Questions such as why humans make certain choices when faced with equal alternatives, or why human economic behaviour changes when clear rational models that ought to drive their decisions exist, are just some of the questions that guide this research. These examples can be observed in the real world and are scrutinized by studying many variables, such as risk, uncertainty, or bounded rationality (Kahneman, 2003). A neuroscientific perspective allows us to analyse this phenomenon in a deeper, more thorough manner, and to link it with emotional and physiological approaches (Hsu, Bhatt, Adolphs, Tranel, & Camerer, 2005).

«Feelings and emotions play a crucial role in determining our economic behaviour»

Take, for example, a person thinking about purchasing a new apartment. Several variables may influence this person’s decision to buy a given apartment. For instance, this person might want to live in the same neighbourhood where they spent their childhood, or the apartment might be both closer to their work and near a park where they can practice outdoor sports. A traditional economic approach would aim to explain this person’s decision from a rational point of view; that is, a choice to maximize their own profit and individual utilities. Should this person be a fully informed consumer, they would be able to rank their buying preferences according to their personal utility, needs, and characteristics (e.g., whether or not the apartment has a garage or a garden, the socioeconomic level of the neighbourhood, public transport availability, etc.). However, as humans, feelings and emotions can also play a crucial role in determining our economic behaviour (Rick & Loewenstein, 2008), and so does our ability to manage emotions in a given context (Gross & John, 2003). Past and recent studies in both psychological and neuropsychological sciences (Davidson, Putnam, & Larson, 2000) have explored how humans address their need to effectively manage the plethora of emotional stimuli that arises in certain situations (e.g., when visiting an apartment close to the place where we grew up, or during the bargaining process with the seller). Such cognitive and affective regulation is critical to achieve satisfactory economic outcomes, but it is also important in our everyday life.

The work we present here is structured in the following way: First, we introduce the notion of neurobehavioral finance, which acts as the theoretical background for the subsequent sections. Next, we explore the brain structures involved in decision-making processes and the factors that might influence them. We then move from human «hardware» to «software», exploring the resulting emotional states involved in decision making and using inherited behavioural traits as a bridge between body and mind. The focus then moves to exploring the social aspects involved in economic decisions, such as rumours and economic bubbles. Finally, we come full circle by elaborating on how a controlled social environment (e.g., a laboratory) could be informative, not only regarding the economic behaviour of individuals, but also their emotional states and strategies, as well as their brain chemistry.

Neurobehavioral finance

Although words such as emotions or expectations may seem to be abstract concepts for some of our readers, they are actually very present in every interaction we have with our environment. Furthermore, emotions and expectations have, on the one hand, specific neurophysiological correlates – we can pinpoint which area of the brain is activated by a specific emotion or thought process involving an expectation (e.g., decision-making processes; Bechara, Damasio, & Damasio, 2000) – and, on the other hand, they have a specific and measurable impact on the life of the individual and of others; in other words, they can influence an individual’s behaviour.

Our previous example clearly shows the importance of expectations when considering situations from an economic perspective. For example, rational individuals try to make the best possible decision in critical life events (e.g., when purchasing a new apartment), because in these situations each decision has a deep emotional impact on many aspects of their future life. If making the right decisions seems very important from an individual’s point of view, imagine the potential importance of the economic decisions made by traders in stock markets, or even by politicians who determine the fate of a country or nation. Consequently, one clear goal of neurobehavioral finance is to better understand what the neuropsychological determinants of economic expectations are, as well as their emotional correlates.

One research avenue of neurobehavioral finance focuses on variables, both at the micro and macro level, which explain human behaviour in relation to financial markets. For example, although a lot of resources and effort have been invested in finding out which economic variables cause market fluctuations, every attempt so far has failed to stop the cyclic emergence, and inevitable burst, of financial bubbles. In other words, controlling these fluctuations – anticipating and avoiding them – is one of the main objectives of traditional financial research (Blanchard & Watson, 1982). However, trying to think outside the box, some authors suggest that, although much has been said about expectations, the role of emotions within financial systems may have been neglected. More precisely, if emotions can be seen as the affective counterpart of rational expectations, they should not be regarded as less important in shaping and creating speculative financial bubbles, or across different market processes (Tseng, 2006). Hence, if economists joined forces with psychologists and neuroscientists, their collective wisdom could enhance our understanding of the ultimate motives behind the behaviour of financial agents, which may not be directly explained by rational models. In particular, they could provide some guidance in the prevention of future financial bubbles.

The emotional brain

The famous case of Phineas Gage (Damasio, Grabowski, Frank, Galaburda, & Damasio, 1994) is considered a milestone in neuroscience. After this study was published in Science, the notion that particular neural areas and pathways are responsible in decision-making, social cognition, and environmental adaptability became accepted as scientific fact. In 1848, Phineas Gage suffered a tragic accident while working on New England’s railroad industry. Before that accident, he was an average citizen, intelligent and socially well-adjusted. However, after the accident, his personality changed radically. He behaved in a disrespectful manner, displayed infantile behaviours, or even engaged in sexually explicit exposures that offended his social circle. Most surprisingly, despite this change in behaviour after the accident, his intelligence levels remained the same. Decades later, neuroscience studies linked the damages in several of Phineas Gage’s neural areas and brain connections with cognitive functions related to planning, execution, personality, decision-making, and what we commonly understand as «rationality». All these areas have inseparable connections with brain areas related to emotional regulation. Thus, if they suffer brain damage, this can lead the individual to make erratic decisions (and behaviours).

The damaged brain areas in Gage’s case (and many others with a similar clinical background) were those connecting the limbic brain (in charge of eliciting basic emotions), with the prefrontal cortex, which deals with these emotions in a planned and rational way. Dozens of studies have shown that when either of these areas or their underlying circuits are damaged, individuals lose the ability to make an optimal choice (Shiv, Loewenstein, Bechara, Damasio, & Damasio, 2005). More precisely, there is a key neural area in the limbic brain that elicits negative emotional responses such as fear: the amygdala. This neural area is located within the temporal lobes of both hemispheres, and its connections reach vast parts of the neocortex, like the orbitofrontal region or ventromedial prefrontal cortex, the anterior cingulate cortex, the cortex of the insula, and other subcortical nuclei, such as the thalamus, basal ganglia, or hypothalamus. Any damage to these areas or the circuits interconnecting them involves a deficiency in social decision making (Adolphs et al., 2005). These areas also regulate different types of empathy and, in the case that we suffer any neural damage to them, we might lose our ability to recognize the emotions and thoughts of those around us.

«The “somatic marker hypothesis” suggests that the function of neurological structures and psychological (cognitive-emotional) mechanisms is unified»

Identifying the source of negative emotions such as fear leads to the formulation of the «somatic marker hypothesis». In short, this hypothesis suggests that the function of neurological structures and psychological (cognitive-emotional) mechanisms is unified. Furthermore, this implies the need for a harmonious flow between cognitions and emotions in order to be able to make decisions that result in adaptive behaviour, whether their nature is social or economic. Such findings, and subsequent theorizing based on these results, are relevant for the broader field of neuroeconomics. For example, it has been noted that subjects with neural damage in the aforementioned areas make economic decisions that challenge the concept of economic rationality: some patients with different types of neural damage were able to obtain greater economic profits than normal individuals would have (Shiv et al., 2005). It seems that fearlessness allowed these patients to make high-risk investments and harvest the consequent earnings. However, because correlation does not imply causation, this study also raises the possibility that a personality profile with an excessive tendency towards risk-taking behaviours and the expectation of quick and high payoffs, as seen in many financial brokers, may lead to neuropsychological issues. In this sense, neuronal functionality in such decisions could be decisive in the explanation of excessive risk-taking in economic transactions, the creation of economic bubbles, or our own economic crisis.

The role of fear and greed

A truism in financial markets is that fear and greed are what shapes systematic fluctuations that later derive into financial bubbles. Westerhoff (2004), for instance, proposed a behavioural model that predicts stock price fluctuation by factoring in how strongly the financial behaviour of traders is driven by these two emotions. Due to the importance of fear and greed in influencing financial behaviour, we can elaborate on the neuropsychological processes behind these affective states and their respective behavioural responses.

Most psychologists have defined the concepts of fear and greed in relation to risk and uncertainty (Biel & Gärling, 1995). On the one hand, if we have a look at greed-related factors, we find excessive levels of optimism and overconfidence – potentially caused by underestimating the risks – or excessive levels of personal desires. As depicted by Jin and Zhou (2011), greed has two defining features: first, it involves a strong desire for wealth; second, it involves the satisfaction of that desire by executing an aggressive action. Not surprisingly, Jin and Zhou consider greed as one of the potential causal factors behind the financial crisis. More importantly, greed influences decision making because, in order to reach higher profit targets, higher risks need to be assumed (e.g., buying toxic assets), which is the ultimate cause of the development of bubbles. In this sense, hormones like testosterone, related with social dominance and status, foster the greedy and aggressive behaviours underlying market settings.

What can neuroscience tell us about the biological basis of greed? Although not many studies have analyzed this particular topic, accepting that greed is an egoistic self-oriented ensemble of positive emotions (i.e., happiness, joy, and pleasure turned to one’s own profit), neurobiology can tell us a lot about it. In this sense, each individual is hardwired with a reward system, which segregates a number of neurotransmitters that induce what humans experience and describe as «pleasure». More specifically, the nucleus accumbens is the neural area that originates pleasure feelings, thanks to a neurotransmitter called «dopamine». Dopamine is always released when something appears to be necessary for our survival, like eating, drinking, having sex, protection, etc.

«When we perceive a monetary gain, the reward system is activated by releasing dopamine into the nucleus accumbens, thus causing a gratifying sensation»

Similarly, because traders tend to define themselves in terms of their profits, they always get a dopamine release when an economic transaction becomes profitable. Thus, as Gordon Gecko from Wall Street would have it, it seems that «greed is good», because when we perceive a monetary gain, the reward system is activated by releasing dopamine into the nucleus accumbens, thus causing a gratifying sensation (Breiter, Aharon, Kahneman, & Shizgal, 2001). Furthermore, perceiving a monetary gain activates not only the nucleus accumbens, but also other areas such as the amygdala and the hypothalamus, the neural centre of the endocrine system. This area releases testosterone as a result of the «winner effect» and, consequently, one’s position in the social ladder increases.

Then, what would happen to traders who obtained substantial profits several consecutive times? In fact, from a neurochemical point of view, winning can have the same effect than an illegal substance, and the brain will adapt to its thrill as it does to any other drug (usually substances are considered illegal due to their ability to hijack the reward system, which leads to a dopamine imbalance). Therefore, as with drugs, our brain will ask for more and more «winning experiences». Similar to shopping or gambling, trading and winning several times, which increases power and recognition in a social environment such as the trading floor, can become truly addictive.

On the other hand, fear is related to risk uncertainty. Indeed, Cheekiat Low (2004) stated that pressures in financial markets are always dominated by fear. Moreover, fear can be understood as a psychological state that results from extreme risk aversion. As mentioned above, the «winner effect» activates the endocrine system, releasing several hormones (including testosterone), as a response to a step up the social ladder or to consecutive monetary gains. But there is also another face to this positive outcome: the fear of losing this recently-acquired power and wealth. The stress hormone Cortisol is the neurochemical substrate behind this winning-losing tandem, and is released into the hypothalamus by the amygdala, an area that reacts to every stimuli perceived as an attempt to menace our survival, wealth, or status. Hence, when somebody wins, dopamine and testosterone are released, but cortisol also increases. This process is reversed according to the outcome, both in animals and humans.

«From a neurochemical point of view, winning can have the same effect than an illegal substance»

Fear and greed may have a direct effect on trading stability and bubble development, and negative consequences on financial markets. But, it is important to note that the role of emotions in financial decisions is not limited to greed and fear. Evidence showing the negative relationship between emotional reactivity and agent trading performance has been used, for instance, to explain the link between price fluctuations and investor wealth. Interestingly, researchers have confirmed this relationship using a clinical sample of day-traders1, providing additional evidence of the relevance of emotions in this field of research.

DFrom a psychological point of view, the study of individual differences in stock market psychology has helped to clarify whether what makes for successful investors is learnt or is genetically inherited. On the one hand, research on emotional competencies suggests that traders can learn how to regulate emotions such as fear and greed. In this sense, emotional competencies are understood as the set of knowledge, skills, and abilities that allow people to identify, understand and manage their own and others’ emotions (Mayer, Roberts, & Barsade, 2008). On the other hand, research on personality psychology affirms that we are born with five personality traits, one of them being emotional stability. Emotional stability is understood as a natural tendency to trust oneself, both in terms of one’s decisions and quality of work (Judge & Bono, 2001). Thus, traders with higher emotional stability will have stronger self-mastery, and become less susceptible to letting excessive fear or greed influence their decision-making while trading.

Finally, fear and greed can shape psychological states, or mind-sets. Westerhoff’s case is that traders tend to react optimistically (expectations) when the market steadily rises and, as a result, they buy stocks (behavioural response). Conversely, their behaviour is different when stock prices change too much and too quickly, since agents tend to panic (emotion) and sell stocks (behavioural response). Generally speaking, although we cannot assume that investors are irrational in economic terms, it is fair to say that the rationality of their behaviour could be strongly influenced by fear and greed. In this sense, the greed of investors is motivated by high spirits and positive expectations towards the market, which are the building blocks of a «bullish» mind-set. A bullish mind-set, in turn, influences their economic behaviour towards buying, which leads to an increase in the purchase of financial instruments based on future contracts. On the other hand, fear results in a low mood and in negative expectations regarding the market’s future, which elicits a «bearish» mind-set. A bearish mind-set usually results in a very negative behavioural outcome: selling behaviour, which thus, results in a decrease in the prices of instruments.

The ultimatum game explained by neuroeconomics

Neuroeconomics is a field that combines the techniques of neuroscience research and behavioural games in an economics context. One of the most interesting examples is the ultimatum game, an economic game to experimentally study the economic decisions of participants in a simple environment (Güth, Schmittberger, & Schwarze 1982). In this game, two people interact anonymously once. Participant A is given a sum of money (e.g., $10) and asked to divide this amount with participant B, whom participant A does not know, and will not know even after the end of the game. If participant B, who knows the amount of money that participant A has ($10), accepts the participant A’s proposal, the $10 amount will be split between the two participants according to participant A’s decision. If participant B does not accept the proposal, both participants will earn nothing. Now, the interesting aspect of this behavioural game is given to us by game theory. Assuming the full rationality of all agents, participant B should accept any positive amount of money, because the new situation will improve from a monetary point of view. However, bids of $2 or less received by B participants are generally rejected in most developed countries.

Why do participants who receive small sums of money reject the proposal? Some neuroeconomic studies have shown that participants do not need to suffer from brain damage or a hormonal neurotransmitter imbalances to make irrational choices. In this paradigm, the level of hormones and the neural receptors in areas of the somatic marker play a crucial role. Using complex analysis techniques to monitor brain activity when participants make decisions, it has been observed that participants who reject small sums of money have high levels of brain activation in the insula, an area related to feelings of disgust (Gallese, Keysers, & Rizzolatti, 2004). Similarly, Mehta and Beer (2010) observed that in addition to presenting high levels of activity in the insula these subjects also had high levels of testosterone, which implies that these behaviours are related to a defence of status. As already suggested, these observations take into account the fact that humans are social beings concerned with their social identity and this includes feelings, beliefs, and emotions. From this point of view, while rejecting money implies a loss of resources, this response is a way to punish those who try to abuse their power and also prevents the person from receiving a small sum of money in the future by protecting them from acquiring a reputation as «exploitable».

«Empathy seems to be the mechanism that explains why people are generous»

As shown, patients with high levels of testosterone are less generous and less trusting (Zak et al., 2009). Another question that resulted from this type of experiment is: why should a person offer a very large sum of money? Just as disgust is the reason for rejecting small sums of money, empathy seems to be the mechanism that explains why people are generous. Empathy is the ability to get emotionally involved with people around us. Therefore, an empathetic participant is expected to offer larger sums of money in the ultimatum game than someone who is not. To test this argument, neuroeconomics uses experimental techniques for manipulating the empathy levels of participants, for example by controlling the levels of oxytocin, the «hormone of love». Oxytocin is related to the levels of trust and empathy which different people display. Thus, people who received an oxytocin infusion offered sums of money that were 80% higher than those who did not receive the infusion (Kosfeld, Heinrichs, Zak, Fischbacher, & Fehr, 2005).

Using experimental designs such as the ultimatum game, neuroeconomics aims to analyse the mechanisms through which humans make decisions. As shown in the above examples, this discipline seeks to understand aspects of human behaviour that cannot be explained considering them as purely rational actors.

Conclusions

Considering the work in the finance sector as a decision-making process in which expectations and emotions play a crucial role, these concepts cannot be separated from behavioural approaches. In this sense, one of the most important goals in finance is how to predict market fluctuations. We propose that in order to better understand these processes, alongside emotions such as fear and greed, we must also take expectations into consideration. Furthermore, our work is based on a recent consensus in the neuroscience field that rejects the mind/brain duality, instead proposing the existence of a singular entity that produces psychological processes. Thus, whereas differences in brain structures may alter an individual’s behaviour, as occurred to Phineas Gage, neuroscience posits that behaviour may alter brain structure. Finally, from a neuroscientific perspective, emotions are not determinant, but crucial for making efficient decisions. Moreover, the effects of hormones such as cortisol, testosterone or oxytocin regulate the balance of making riskier, greedy, or prosocial decisions. This suggests that training our brain, in addition to controlling the markets, may have a direct impact on the prevention of negative financial scenarios.

«If a person can master emotions such as fear and greed, they will be able to make an informed but voluntary and self-determined choice»

Based on our first example, we are closer to understanding how the brain works when a person is considering purchasing a new apartment, and how that decision, embedded in larger expectations, elicits emotions which, in turn, influence brain activity. So, the way emotions are managed plays a crucial role in the purchase process. To avoid negative emotions such as fear, the buyer should not try to reduce their «feelings», looking for a rational way to measure the purchase (e.g., quantifying price variables), but rather, they should embrace them: by reflecting upon how they feel at that moment, they will automatically activate the neocortex areas that regulate emotional tone. Hence, if they can master emotions such as fear (but also greed), they will be able to make an informed but voluntary and self-determined choice.

«Rather than the trendy quackery based on magical solutions, fact-based evidence regarding which techniques are useful for our emotional management is available»

To conclude, emotional regulation presents itself as an attractive resource. Rather than the trendy quackery based on magical solutions spread by a huge self-help industry, fact-based evidence regarding which techniques are both useful and within our reach is available. If emotions, hormones, and environments are all connected, we should intervene in this multi-dimensional arena in order to preserve and protect our welfare society and the common good. In this vein, individual responsibility, evidence-based programs on emotional intelligence, emotional regulation, and genuine leadership may provide truly useful skills to make the right decisions. Despite not yet being a reality, this is a good place to start.

1. Day traders perform operations that – in general – must be closed before the end of the trading day. Their activities usually involve a great deal of risk, which can result in large earnings but also big loses. (Go back)

References

Adolphs, R., Gosselin, F., Buchanan, T. W., Tranel, D., Schyns, P., & Damasio, A. R. (2005). A mechanism for impaired fear recognition after amygdala damage. Nature, 433(7021), 68–72. doi: 10.1038/nature03086

Bechara, A., Damasio, H., & Damasio, A. R. (2000). Emotion, decision making and the orbitofrontal cortex. Cerebral Cortex, 10(3), 295–307. doi: 10.1093/cercor/10.3.295

Bertrand, M., Mullainathan, S., & Shafir, E. (2006). Behavioral economics and marketing in aid of decision making among the poor. Journal of Public Policy & Marketing, 25(1), 8–23. doi: 10.1509/jppm.25.1.8

Biel, A., & Gärling, T. (1995). The role of uncertainty in resource dilemmas. Journal of Environmental Psychology, 15(3), 221–233. doi: 10.1016/0272-4944(95)90005-5

Blanchard, O. J., & Watson, M. W. (1982). Bubbles, rational expectations and financial markets. NBER Working Paper Series, 945. doi: 10.3386/w0945

Breiter, H. C., Aharon, I., Kahneman, D., Dale, A., & Shizgal, P. (2001). Functional imaging of neural responses to expectancy and experience of monetary gains and losses. Neuron, 30(2), 619–639. doi: 10.1016/S0896-6273(01)00303-8

Camerer, C. (2007). Neuroeconomics: Using neuroscience to make economic predictions. The Economic Journal, 117(519), C26–C42. doi: 10.1111/j.1468-0297.2007.02033.x

Camerer, C., Loewenstein, G., & Prelec, D. (2005). Neuroeconomics: How neuroscience can inform economics. Journal of Economic Literature, 43(1), 9–64. doi: 10.1257/0022051053737843

Damasio, H., Grabowski, T., Frank, R., Galaburda, A. M., & Damasio, A. R. (1994). The return of Phineas Gage: Clues about the brain from the skull of a famous patient. Science, 264(5162), 1102–1105. doi: 10.1126/-science.8178168

Davidson, R. J., Putnam, K. M., & Larson, C. L. (2000). Dysfunction in the neural circuitry of emotion regulation—A possible prelude to violence. Science, 289(5479), 591–594. doi: 10.1126/science.289.5479.591

Gallese, V., Keysers, C., & Rizzolatti, G. (2004). A unifying view of the basis of social cognition. Trends in Cognitive Sciences, 8(9), 396–403. doi: 10.1016/j.tics.2004.07.002

Gross, J. J., & John, O. P. (2003). Individual differences in two emotion regulation processes: Implications for affect, relationships, and well-being. Journal of Personality and Social Psychology, 85(2), 348–362. doi: 10.1037/0022-3514.85.2.348

Güth, W., Schmittberger, R., & Schwarze, B. (1982). An experimental analysis of ultimatum bargaining. Journal of Economic Behavior and Organization, 3(4), 367–388. doi: 10.1016/0167-2681(82)90011-7

Hsu, M., Bhatt, M., Adolphs, R., Tranel, D., & Camerer, C. F. (2005). Neural systems responding to degrees of uncertainty in human decision-making. Science, 310(5754), 1680–1683. doi: 10.1126/science.1115327

Jin, H., & Zhou, X. Y. (2011). Greed, leverage, and potential losses: A prospect theory perspective. Mathematical Finance, 23(1), 122–142. doi: 10.1111/j.1467-9965.2011.00490.x

Judge, T. A., & Bono, J. E. (2001). Relationship of core self-evaluations traits — self-esteem, generalized self-efficacy, locus of control, and emotional stability — with job satisfaction and job performance: A meta-analysis. Journal of Applied Psychology, 86(1), 80–92. doi: 10.1037/0021-9010.86.1.80

Kahneman, D. (2003). A perspective on judgment and choice: Mapping bounded rationality. American Psychologist, 58(9), 697–720. doi: 10.1037/0003-066X.58.9.697

Kosfeld, M., Heinrichs., M, Zak, P. J., Fischbacher, U., & Fehr, E. (2005). Oxytocin increases trust in humans. Nature, 435(2), 673–676. doi: 10.1038/nature03701

Low, C. (2004). The fear and exuberance from implied volatility of S&P 100 Index Options. The Journal of Business, 77(3), 527–546. doi: 10.1086/386529

Mayer, J. D., Roberts, R. D., & Barsade, S. G. (2008). Human abilities: Emotional intelligence. Annual Review of Psychology, 59, 507–536. doi: 10.1146/annurev.psych. 59.103006.093646

Mehta, P. H., & Beer, J. (2010). Neural mechanisms of the testosterone–aggression relation: The role of orbitofrontal cortex. Journal of Cognitive Neuroscience, 22(10), 2357–2368. doi: 10.1162/jocn.2009.21389

Rick, S., & Loewenstein, G. (2008). The role of emotion in economic behavior. In M. Lewis, J. M., Haviland-Jones, & L. Feldman Barret (Eds.), Handbook of emotions. Third edition (pp. 138–156). Nova York, NY: Guilford Press.

Shiv, B., Loewenstein, G., Bechara, A., Damasio, H., & Damasio, A. R. (2005). Investment behavior and the negative side of emotion. Psychological Science, 16(6), 435–439. doi: 10.1111/j.0956-7976.2005.01553.x

Tseng, K. C. (2006). Behavioral finance, bounded rationality, neuro-finance, and traditional finance. Investment Management and Financial Innovations, 3(4), 7–18.

Westerhoff, F. H. (2004). Greed, fear and stock market dynamics. Physica A: Statistical Mechanics and its Applications, 343, 635–642. doi: 10.1016/j.physa.2004.06.059

Zak, P. J., Kurzban, R., Ahmadi, S., Swerdloff, R. S., Park, J., Efremidze, L., ... Matzner, W. (2009). Testosterone administration decreases generosity in the ultimatum game. PLoS One, 4(12), e8330. doi: 10.1371/journal.pone.0008330